Published: 22 December 2017

Continuous growth in households’ net financial assets for eighteen months

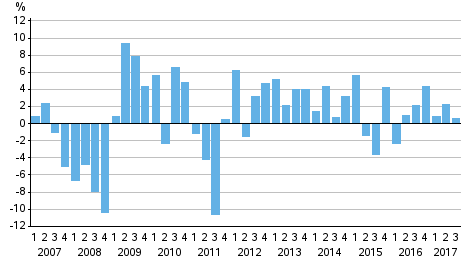

Households' financial assets grew by EUR 2.1 billion during the third quarter of 2017. At the end of the quarter, financial assets amounted to EUR 304.9 billion. Over the same period, households had EUR 159.1 billion in debt which was EUR 1.2 billion up from the previous quarter. As a result of these changes, the difference of households’ financial assets and liabilities, or net financial assets grew by EUR 0.9 billion to EUR 145.8 billion in July to September. The growth has continued uninterrupted for six quarters. These data derive from Statistics Finland’s financial accounts statistics.

Change from the previous quarter in households net financial assets

Holding gains raised households’ financial assets

During the third quarter of 2017, households increased their net investments in financial assets by EUR 0.6 billion. Investments in cash, current accounts and other transferable deposits grew on net by EUR 0.9 billion in total. In total, EUR 0.4 billion more new investments flowed to quoted shares and mutual fund shares than assets were withdrawn from them. In turn, investments in time deposits and debt securities decreased on net.

The majority, nearly EUR 1.6 billion, of the rise in the total level of households’ financial assets came from holding gains. They accumulated due to a value increase of assets invested in both shares and mutual shares.

Households’ indebtedness ratio rose

Households’ loan debts increased by EUR 1.8 billion in the third quarter of 2017. Loan debts amounted to EUR 146.9 billion at the end of the quarter. Households' indebtedness ratio rose by 0.5 percentage points from the previous quarter to 127.8 per cent. Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters.

Non-financial corporations’ financing in the form of debt securities decreased

Non-financial corporations’ debt financing declined by EUR 0.9 billion during the third quarter of 2017 to EUR 239.1 billion. Debt financing refers to non-financial corporations’ loan debts, and commercial papers and other debt securities issued primarily by large corporations. Non-financial corporations’ financing in the form of debt securities decreased to EUR 31.7 billion, a drop of EUR 2.3 billion from the level at the end of June. The fall was offset by a EUR 1.4 billion growth in non-financial corporations’ loan debts to the level of EUR 207.4 billion. Here, the non-financial corporations sector has been limited so that it does not include financial and insurance corporations nor housing companies or other housing associations.

Source: Financial accounts, Statistics Finland

Inquiries: Henna Laasonen 029 551 3303, Peter Parkkonen 029 551 2571, rahoitus.tilinpito@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (247.4 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

- Revisions in these statistics

-

- Revisions in these statistics (22.12.2017)

Updated 22.12.2017

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 3rd quarter 2017. Helsinki: Statistics Finland [referred: 16.4.2024].

Access method: http://www.stat.fi/til/rtp/2017/03/rtp_2017_03_2017-12-22_tie_001_en.html