This set of statistics has been discontinued.

New data are no longer produced from the statistics.

Published: 19 April 2018

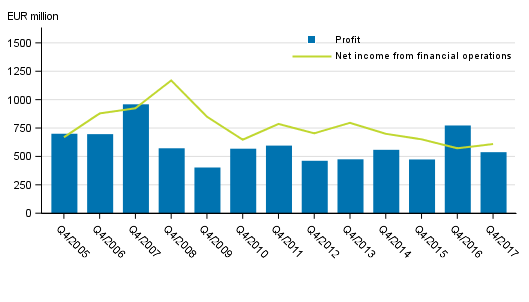

Net income from financial operations of banks operating in Finland grew, but operating profit decreased in the fourth quarter of 2017

In the fourth quarter of 2017, the net income from financial operations of credit institutions engaged in banking in Finland amounted to EUR 609 million and their operating profit was EUR 537 million. The net income from financial operations went up by EUR 37 million and the operating profit declined by EUR 235 million from one year ago. These data derive from Statistics Finland’s financial statement statistics on credit institutions.

Net income from financial operations and operating profit of banks operating in Finland, 4th quarter 2005 to 2017, EUR million

Interest income and expenses

Credit institutions engaged in banking in Finland accumulated EUR 1.1 billion in interest income in the fourth quarter of 2017, which was EUR 19 million less than one year previously. Interest expenses, in turn, fell by EUR 56 million year-on-year to EUR 497 million. Net income from financial operations calculated as the difference between interest income and expenses grew by EUR 37 million or by around six per cent. Measured in percentages, interest income declined by 1.7 per cent and expenses by 10 per cent.

Interest income for the whole year amounted to EUR 4.6 billion, which was 3.3 per cent less than in 2016. Banks’ total interest expenses amounted to EUR 2.2 billion in 2017, having been EUR 2.3 billion in 2016.

Administrative expenses

Administrative expenses are the single largest expenditure item of banks operating in Finland. In the fourth quarter, banks had EUR 763 million in administrative expenses, which was EUR 39 million less than in the year before. Wages and salaries represented 42.7 per cent of administrative expenses. Compared to the fourth quarter of 2016, total wages and salaries decreased by EUR 42 million to EUR 326 million. In the whole year 2017, administrative expenses amounted EUR 2.9 billion. Compared to 2016, administrative expenses decreased by EUR 30 million.

Operating profit

The operating profit, or profit from continuing operations before taxes, was EUR 537 million. Compared with EUR 772 million in the fourth quarter of 2016, the operating profit decreased by EUR 235 million or 30 per cent. In particular, clearly decreased gains on financial assets and liabilities held for trading explain the drop in the operating profit. Fluctuations in the operating profit by quarter can be large. The operating profit of banks generated in 2017 totalled EUR 2.1 billion, which was EUR 0.7 billion less than one year ago.

Balance sheet

The aggregate value of the balance sheets was EUR 350 billion. The balance sheet was 26.7 per cent down from one year ago. The share of own equity in the total of the balance sheets was five per cent or around EUR 17 billion. Banks’ own equity declined by EUR 10 billion from the year before.

A company restructuring made in the Finnish banking sector in the first quarter of 2017 explains a majority of the unexceptionally large changes in the balance sheets and, in particular, in equity.

Source: Credit institutions' annual accounts, Statistics Finland

Inquiries: Antti Suutari 029 551 3257, Jarkko Kaunisto 029 551 3551, rahoitusmarkkinat@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (270.7 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

Updated 19.4.2018

Official Statistics of Finland (OSF):

Financial statement statistics on credit institutions [e-publication].

ISSN=2342-5180. 4th quarter 2017. Helsinki: Statistics Finland [referred: 27.4.2024].

Access method: http://www.stat.fi/til/llai/2017/04/llai_2017_04_2018-04-19_tie_001_en.html